Blogs

“Assignment” setting the newest import from the one occupant of all passions produced by a rental agreement. “Action” mode one recoupment, counterclaim, setoff, or any other civil step and any other continuing in which legal rights have decided, along with tips to possess palms, lease, unlawful detainer, unlawful entryway, and you may stress for rent. Influence on the credit can vary, as the credit ratings is on their own influenced by credit reporting agencies based on a lot of points such as the monetary choices you will be making with almost every other financial functions organizations. Banks that offer a bank checking account added bonus in order to the fresh account holders is Bank out of The united states, BMO, Money You to definitely, Chase, Citibank, KeyBank, PNC Bank, SoFi Bank, Letter.An excellent., TD Lender, You.S. Financial and you will Wells Fargo. Discover this site each month for the best checking account promotions readily available.

Tips determine your own 2024 Nyc Condition taxation | BetX101

The new sixty-day-rule extends to 120 weeks if the private are a keen Indian resident or PIO going to India that have full money (excluding international earnings) around ₹15 lakh. Point 115F comprehend which have Section 115C of one’s Tax Act also offers NRIs a fantastic chance to spend zero income tax to your a lot of time-label financing gains from foreign exchange BetX101 possessions. In case your citizen is the owner of their are built household and the park owner desires these to exit while they want to alter the have fun with of one’s belongings, they should afford the resident a great stipend as much as $15,000 so you can make up her or him to the cost of swinging the house. All of the are built house park renting need were a rider out of occupant rights.

Mississippi Leasing Assistance Software

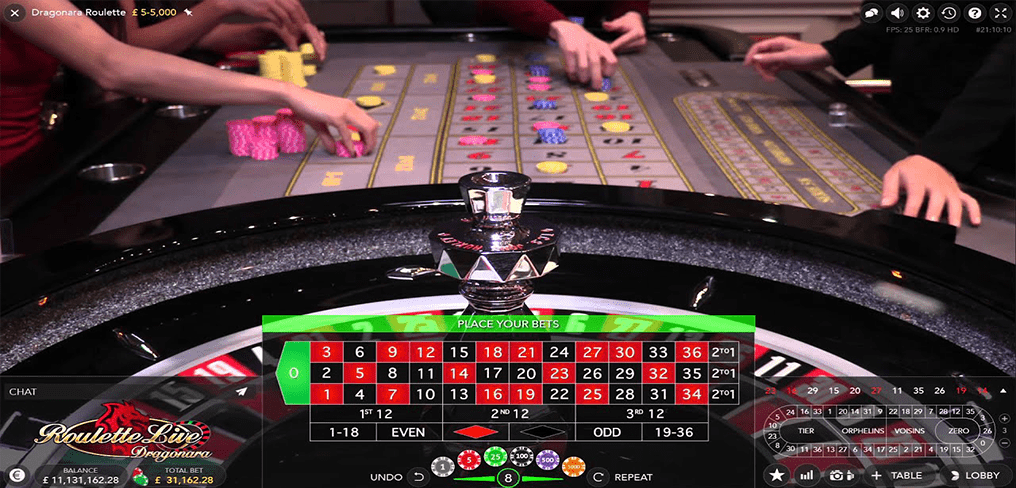

Top Gold coins is an excellent program for online slots games with tons from preferred favorites and you will undetectable gems. Crown Coins is additionally most ample which have bonuses for brand new and you can present people and it has a modern each day login incentive one initiate at the 5,100000 CC. Top Coins provides more than 450 games from great app business, in addition to smash attacks Glucose Hurry and you will Huge Trout Bonanza. You will get 100 percent free daily money incentives and an incredibly-ranked software to have new iphone 4 (maybe not Android, though).

When you are everyone can become a member of such credit unions, you will possibly not be able to open all types out of account with them. Of many borrowing unions do not have bodily twigs offered across the country; they are limited to a few claims. When the those people borrowing from the bank unions require some profile, for example company checking account, as open myself, it may be burdensome for one open those people accounts when the you don’t reside in those individuals states. Furthermore, most reputable credit unions is actually included in NCUA insurance rates, which is offered by the brand new Federal Borrowing from the bank Union Government.

- A notice of every changes by a property owner otherwise occupant inside the any terminology otherwise conditions of a great tenancy from the often will constitute a notification in order to vacate the fresh premises, and you can such as observe out of change is going to be offered prior to the new terms of the new local rental arrangement, or no, otherwise as the if you don’t necessary for rules.

- Postal Service to document their get back, discover Publication 55, Appointed Personal Delivery Features for more information.

- Family members residing an apartment perhaps not protected by rent control, lease stabilization, or other housing ruled because of the a regulating agreement are apt to have no to enable it to be a tenant who passes away otherwise permanently vacates the newest premises.

- Yet not, these types of repayments and you may withdrawals could possibly get qualify for the newest your retirement and annuity income exemption explained regarding the recommendations to possess line twenty eight.

- Also add one area of the federal number which you earned whilst you had been a resident.

The brand new small approach remittance rates is below the newest GST/HST prices of taxation you charges. Consequently your remit simply part of the fresh tax you charge otherwise assemble. The fresh area that isn’t remitted under this technique is actually claimed since the earnings on your own taxation return. As the a good registrant, your get well the fresh GST/HST paid back or payable in your purchases and expenses regarding your own industrial points by claiming an insight taxation credit (ITC) on the range 108 formula if you are filing electronically or online 106 while you are processing a magazine GST/HST return. A non-citizen body’s not necessarily reported to be carrying on company inside Canada to possess income tax objectives given that they that person are considered carrying-on organization within the Canada to have GST/HST motives.

Offers of advisory, contacting, or search features to a non-resident that will be meant to let a low-citizen use up household otherwise present a business venture within the Canada are zero-ranked. But not, we consider a non-resident person that have a permanent organization inside the Canada becoming citizen inside Canada in respect of your own issues continuing in that institution. In case your 2nd supply of legal advice are obtained by a great permanent business in the Canada of your low-resident, who supply out of legal advice might possibly be subject to the new GST/HST. Should your customer is a customer who’s not entered under the normal GST/HST regime, the transaction try nonexempt. The newest registrant who delivers the goods for the individual otherwise an unregistered person has to make up the brand new GST/HST based on the fair market value of the products.

If your offer is eligible, the new inspections you may begin to arrive as soon as the brand new fall away from 2025. Although not, for the moment, citizens would have to watch for far more tangible reports just before they is acceptance the brand new monetary relief guaranteed to them. The fresh $500 inflation relief checks to have family earning below $three hundred,100 per year, and you may $three hundred for individuals and make lower than $150,100000, have been element of Hochul’s challenging proposal to ease the newest monetary stress on The newest Yorkers.

Minnesota Leasing Advice Software

Clients have to be considering the option of which have that it desire paid back on them a-year, applied to rent, or paid off at the end of the fresh rent label. If your strengthening provides under half a dozen leases, a landlord just who willingly metropolitan areas protection deposits inside the a destination-impact savings account also needs to go after these types of legislation. To possess a condo as under book handle, the brand new tenant and/or tenant’s legitimate replacement (such a close relative, spouse, or adult lifestyle companion) have to have become life truth be told there constantly because the before July step one, 1971 (and in some situations because the April step one, 1953). When a lease controlled apartment are vacated in the Nyc otherwise other localities, it will become rent normalized.

So you can assign ensures that the brand new occupant try mobile the whole desire on the apartment rent in order to other people and you will forever vacating the brand new site. The authority to assign the new book is far more restricted than the ability to sublet. An excellent sublet or project and that does not conform to regulations may be grounds for eviction. In order to sublet means that the new renter try temporarily making the fresh flat and this is actually moving less than the complete need for the brand new apartment.